A Comprehensive Guide for Canadians Buying Property on Maui and in Hawaii

Maui and Hawaii as a whole have long been favored destinations for Canadians, attracting numerous buyers and sellers to their stunning shores. If you're a Canadian considering purchasing property on Maui or in Hawaii, it's crucial to understand the unique aspects of the process. In this comprehensive guide, we'll explore key considerations specifically for Canadians looking to buy a home or condo on the islands. From deciding between vacation rentable condos and single-family homes to understanding the differences between fee simple and leasehold ownership, we'll cover the essentials to help you navigate your Maui and Hawaii real estate journey with confidence.

Vacation Rentable Condo or Single-Family Home: Maximizing Usage and Revenue Potential

When contemplating a property purchase on Maui or in Hawaii, consider your intended usage and frequency of visits. Vacation rentable condos offer the opportunity for significant revenue generation when not in use, potentially offsetting ownership costs. Assess factors such as remote work capabilities, travel costs, and responsibilities in Canada. Renting out your property while you're away can provide financial benefits and maximize utilization.

Fee Simple vs. Leasehold Ownership: Understanding the Implications

Maui and Hawaii offer two primary types of property ownership: fee simple and leasehold. Fee simple ownership grants you full rights to the land and its structures, allowing you complete control and ownership until you decide to sell. On the other hand, leasehold ownership involves purchasing the rights to the structure while leasing the land for a specified period. Understanding the implications of each type and considering the lease term duration is essential for informed decision-making.

An Overview of the Buying Process, Fees, and Taxes: Navigating the Hawaiian Real Estate Market

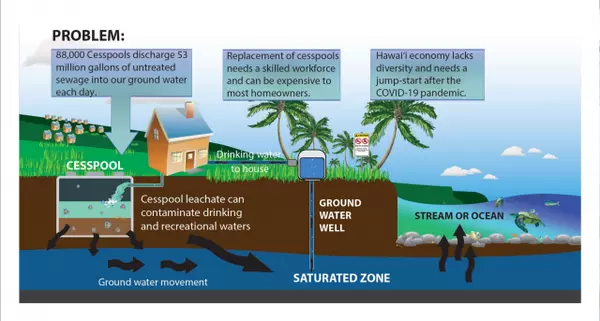

Buying real estate in Hawaii differs from the process in Canada. Title companies and escrow officers handle property transfers and deed completion, with the title process beginning once a property is under contract. Familiarize yourself with fees such as escrow fees and title insurance, along with potential expenses for appraisals, attorney fees, and inspections. Additionally, take note of Homeowners Association (HOA) fees, which cover ownership costs within condo communities and residential subdivisions.

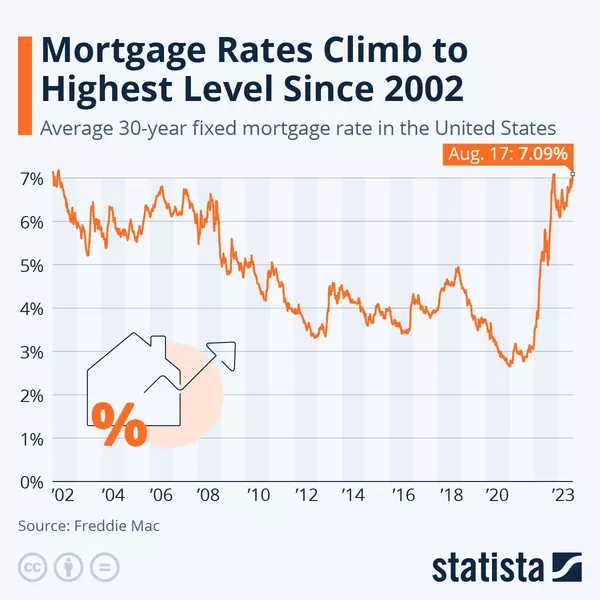

Working with a Local Maui Lender: Financing Your Hawaiian Property

If you plan to finance your Maui or Hawaiian property, collaborating with a local lender licensed in Hawaii is crucial. While U.S.-based credit history may ease the process, it's not always mandatory. Mortgage programs for foreign nationals generally require a down payment of 30% to 35%. Additionally, foreign nationals may encounter slightly higher loan rates compared to U.S. citizens.

Tax Considerations: HARPTA and FIRPTA When Selling

When selling your Maui or Hawaiian property as a foreign national, be aware of tax implications such as HARPTA (Hawaii Real Estate Property Tax Act) and FIRPTA (Foreign Investment in Real Property Tax Act). Sellers must obtain a TIN (Taxpayer Identification Number) and fulfill HARPTA requirements, including paying 7.25% of the sales price at closing. FIRPTA mandates withholding up to 15% of the sales price to ensure compliance with capital gains taxes.

Why Canadians Should Consider Buying Property in Hawaii: The Advantages

1. Escape the Harsh Canadian Winters and Enjoy Year-Round Sunshine:

Canadians often seek refuge from the cold Canadian winters, and Hawaii's year-round warm climate and abundant sunshine offer the perfect escape. Owning a property in Hawaii allows Canadians to enjoy a mild and tropical climate, providing an idyllic retreat whenever they desire respite from the chilly weather back home.

2. Proximity to Canada and Convenient Travel Options:

Hawaii's relative proximity to Canada makes it a convenient destination for travel. Direct flights from major Canadian cities provide easy access to the Hawaiian islands, allowing Canadians to visit their property or invite friends and family for a tropical vacation. The accessibility and connectivity between Canada and Hawaii make owning property in the islands even more appealing.

3. Cultural Connection and Appreciation:

Hawaii shares cultural ties with the indigenous people of Canada, creating a sense of connection for Canadians. The rich Polynesian heritage, traditional arts, music, and hula dance provide an opportunity for Canadians to explore and appreciate diverse cultures while enjoying the beauty of the Hawaiian islands. Immerse yourself in the unique Hawaiian culture and forge meaningful connections during your Hawaiian real estate journey.

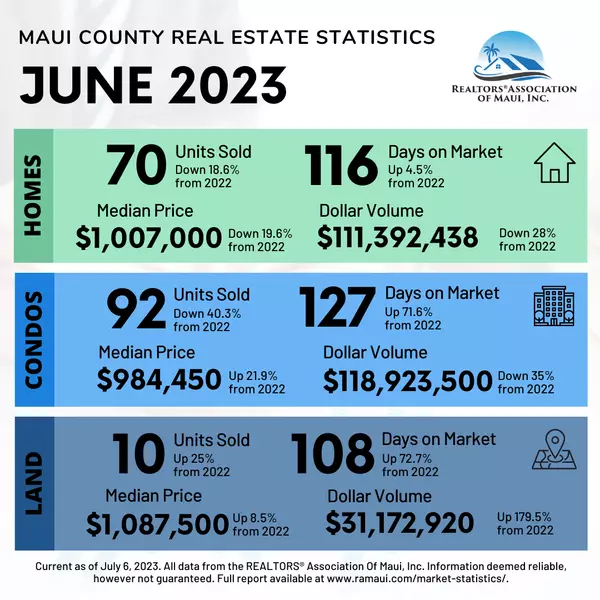

4. Investment Potential and Stable Real Estate Market:

Hawaii's real estate market has demonstrated long-term stability and consistent appreciation, making it an attractive investment opportunity. Canadians can benefit from the potential for personal enjoyment and financial gains by investing in Hawaiian property. With the strong vacation rental market, Canadians can generate income by renting out their property when they are not using it, maximizing the return on their investment.

5. Outdoor Activities and Natural Beauty:

Hawaii's breathtaking natural landscapes, including stunning beaches, lush rainforests, and volcanic formations, offer a playground for outdoor enthusiasts. Canadians who appreciate activities such as surfing, snorkeling, hiking, golfing, and whale watching will find abundant opportunities to indulge in their favorite pastimes in Hawaii. The islands provide an unparalleled backdrop for outdoor adventures and exploration.

6. Diverse Island Lifestyle and Vibrant Communities:

Each Hawaiian island offers a unique lifestyle and atmosphere, catering to various preferences. Whether you seek the vibrant energy of Waikiki in Oahu, the serene beauty of Maui, the untouched nature of Kauai, or the cultural diversity of the Big Island, there is an island to suit every taste and lifestyle. Canadians can find communities that align with their interests and immerse themselves in the diverse island lifestyle that Hawaii offers.

7. Health and Wellness Focus and Active Living:

Hawaii promotes a healthy and active lifestyle, with a strong emphasis on well-being and balance. Canadians who prioritize wellness will appreciate the abundance of yoga studios, wellness retreats, organic markets, and farm-to-table dining options available throughout the islands. Embrace a health-conscious lifestyle and rejuvenate your mind, body, and soul in the tranquil ambiance of Hawaii.

Conclusion:

Owning property on the captivating islands of Maui and Hawaii offers Canadians a remarkable opportunity to experience the beauty, warmth, and cultural richness of these tropical paradises. With a stable real estate market, diverse outdoor activities, favorable climates, and unique advantages, Maui and Hawaii present enticing investment prospects for Canadians seeking a slice of paradise. By considering the key factors outlined in this guide and exploring the benefits of owning property in Hawaii, Canadians can embark on their real estate journey with confidence and make the most of their ownership experience in the Aloha State.

Gray Marino, Real Broker, LLC RS-86136, is a seasoned expert in handling real estate transactions in Maui and Hawaii. With extensive knowledge of the local market, Gray is dedicated to providing personalized service and helping clients find their dream property in paradise. Whether you're looking for a vacation rentable condo, a single-family home, or an investment opportunity, Gray Marino is here to assist you every step of the way.

To start your search for the perfect property on Maui and in Hawaii, visit www.GrayMarino.com. For any inquiries or to discuss your specific real estate needs, feel free to contact Gray Marino directly at 1-808-745-7445 or Gray@GrayMarino.com. I look forward to leveraging my expertise to help you buy your own piece of paradise and create lasting memories in the beautiful Hawaiian islands.

Gray Marino

808-745-7445

Gray@GrayMarino.com

Categories

Recent Posts