How to Afford a Home on Maui: Mastering the Market with Assumable Mortgages - Expert Insights by Gray Marino

Aloha! I'm Gray Marino, your Maui real estate expert with 18 years of experience, particularly in Title & Escrow. In this blog, I delve into how assumable mortgages can be a key strategy in making Maui homeownership a reality, especially in today's dynamic market.

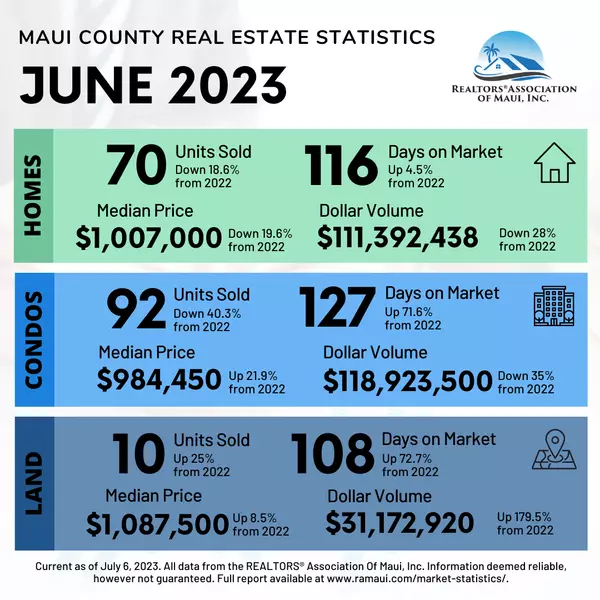

Maui's Real Estate Challenge: Maui's housing market is as beautiful as it is challenging. With soaring prices, buying a home here requires more than just a dream; it requires a strategy. That's where I come in, offering a blend of local expertise and practical advice.

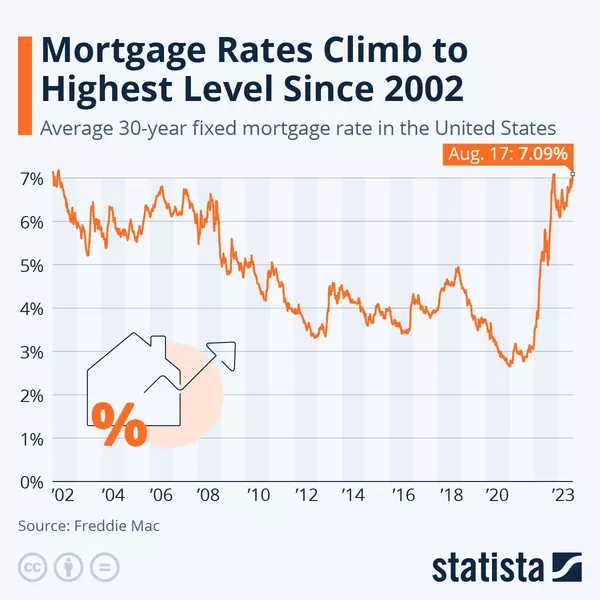

The Rising Relevance of Assumable Mortgages: In a climate of escalating interest rates, assumable mortgages have resurfaced as a viable solution. These unique loans allow you to take over the seller's mortgage terms, including historically lower interest rates.

A Closer Look at the Numbers: Let's dive into the math to understand the impact of current interest rates versus those from a few years ago. Consider a $600,000 mortgage:

- 3% Interest Rate (Past Rate): Monthly payments are around $2,530, totaling approximately $910,665 over 30 years.

- 7% Interest Rate (Current Rate): Monthly payments jump to about $3,992, totaling around $1,437,053 over the same period.

The difference is a staggering $526,388 over the life of the loan, illustrating the significant savings possible with an assumable mortgage.

Current Market Trends and Assumable Mortgages: In today's market, where interest rates are hovering around 7%, finding a seller with a lower-rate mortgage who is willing to let you assume it can be a golden opportunity.

Acting in a Timely Manner: The window for assumable mortgages is often narrow, as their attractiveness hinges on the current economic landscape and interest rate forecasts. Acting now could secure you a rate that might not be available in the near future.

Step-by-Step Guide to Assuming a Mortgage:

- Agreement: Reach a mutual understanding with the seller.

- Lender Engagement: Discuss terms with the existing lender.

- Documentation: Prepare and submit all required financial documents.

- Approval: Undergo lender's credit check and approval process.

- Closing: Complete legal and financial formalities to finalize the transfer.

Considerations for Long-Term Success: While assumable mortgages offer immediate benefits, it's essential to consider the long-term implications, like future rate changes and the impact on your overall financial plans.

Conclusion: In Maui's challenging real estate market, assumable mortgages present a strategic approach to home buying. My experience in Maui's unique real estate landscape equips me to guide you through these intricate decisions.

Your Maui Home Awaits: Explore the latest Maui listings and take a step closer to your dream home. Visit Gray Marino's Listings.

Reach Out for Expert Advice: For tailored guidance on navigating Maui's real estate market, contact me at 808-745-7445 or via email at Gray@GrayMarino.com. Together, we can turn your Maui homeownership dreams into a reality.

Gray Marino

Real Broker, LLC.

RS-86136

Categories

Recent Posts