After pandemic buying frenzy, Maui home prices may ease — but not by much

Although Maui County’s real estate market is facing uncharted territory after the frenzied home buying of the pandemic, Realtors Association of Maui said signs point to slightly softer prices heading into the new year.

Low inventory, though, will keep price tags relatively high, and potential buyers shouldn’t expect costs to plummet to pre-pandemic numbers.

“Because you still have people a little reluctant to put their place on the market unless they know where they’re going to go, the inventory is still not so much and days on market are a little longer . . . That sort of indicates that prices will soften a little — but they’re not going to go crashing down,” Karin S. Carlson, RAM president, told Maui Now this week.

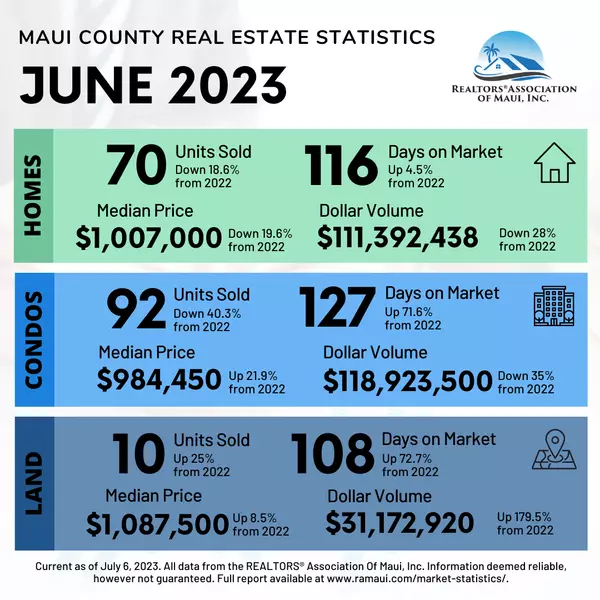

Median sales price for single-family homes in December ticked up less than a percentage point year over year to $1.08 million, according to market statistics released by RAM earlier this week. In 2021, the median was $1.07 million. In 2020, it was $849,000.

For condominium homes, the December median increased 10.5% to $773,500. In 2021, it was $650,000. In 2020, it was $557,000.

Median sales price is the point at which half the sales sold for more and half sold for less in a given month.

Meanwhile, sales last month dropped 45% to 66 for single-family houses, and they fell 61% to 68 for condominium homes, the report said. Days on the market increased 30% for single-family homes and 16% for condos.

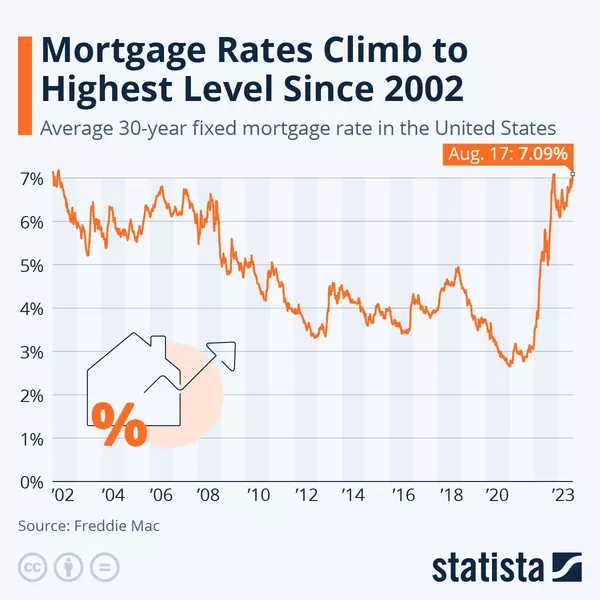

December caps a year that took a sharp turn from the frenzied buying at the heights of the pandemic, where homes drew multiple cash offers above asking price, houses sold fast and interest rates were in the 3% range.

January through May 2022 saw the spillover of busy 2020 and 2021, Carlson said. Then, due to a combination of factors, the housing market started to slow down.

“In May, it was a pivot: It just started to slow down, and you saw less people looking, less people asking,” Carlson said. “Days on market starting to go up. People started to shift their listing price downward if they really needed to get it sold.”

RAM’s president said the change was tied to several factors, including people concerned about the economy, the volatile stock market and the Fed aiming to squash inflation by increasing interest rates.

A December report from University of Hawaiʻi Economic Research Organization said Maui home prices dropped 13% since May, but interest rates continued to keep potential buyers from taking action. Interest rates reached a nearly 20-year high of 7.1% in November 2022. Now, they’re hovering in the 6% range.

Even with the slowdown, Maui County’s lack of inventory will continue to keep prices high because there are not many homes from which to choose, Carlson said.

Plus, the real estate market remains strong and the economy isn’t as bad as it was in the middle of the pandemic, she added.

“At least that’s the way it looks right now — we’re kind of holding steady,” Carlson said.

Still, the future for the post-pandemic housing market remains hard to predict.

“We’ve been saying this for a couple years now — we are in uncharted territory,” Carlson said. “We’re all in this together, and we’re working our way through. Every year’s been like we’ve never seen anything quite like this before.”

Categories

Recent Posts