How to Take Title in Hawaii: Understanding Property Ownership Methods

When it comes to owning property in Hawaii, the method by which you hold title can have significant implications for distribution and taxation upon your passing. Understanding the different tenancy options and their impact on your estate plan is crucial for effective estate planning. This comprehensive guide sheds light on the various property ownership methods in Hawaii. By delving into the distinctions between tenancies, you'll be equipped to make informed decisions regarding your property's title and ensure a seamless estate planning process.

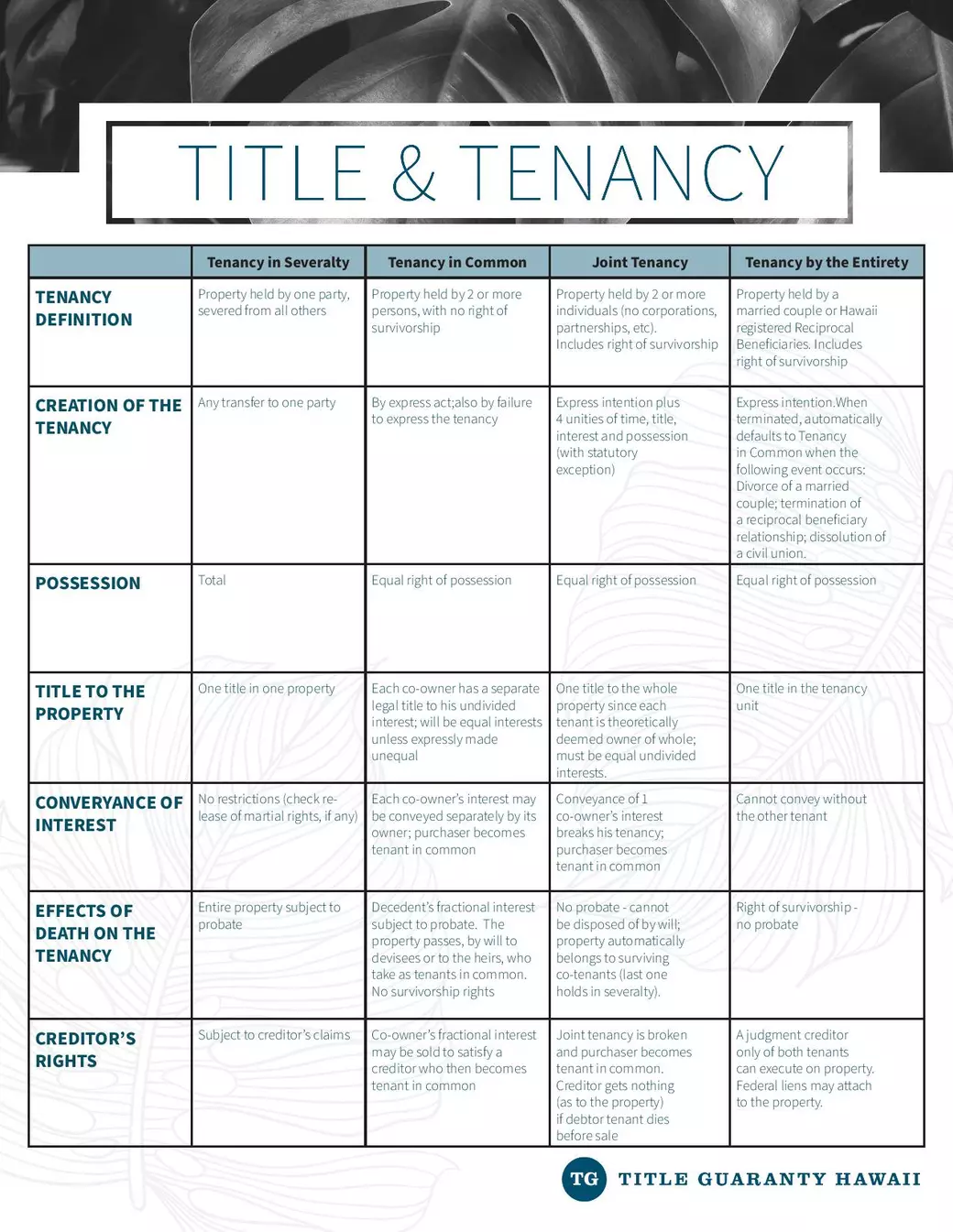

Tenancy in Severalty: Sole Ownership of Property

Tenancy in severalty refers to a property ownership scenario where a single party holds complete ownership of the property, without any co-owners. In this case, the individual's interest is "severed" from others, allowing them full control over the property. This method of ownership is suitable for those who prefer sole ownership and want to maintain exclusive rights over their property.

Tenancy in Common: Shared Ownership with Equal Interests

Tenancy in common involves two or more parties holding undivided, specific interests in a property. This method of ownership applies not only to natural persons but also to corporations, partnerships, trusts, and estates. Each co-tenant's interest is equal to that of the other tenants, unless stated otherwise. The co-tenants are entitled to possess the entire property together. In the absence of specified tenancy arrangements, tenancy in common is the default method of holding title, unless otherwise provided by law.

A tenant in common has the freedom to sell or encumber their interest at any time, with the new owner becoming a tenant in common with the existing co-tenants. It's important to note that a tenant in common's interest is subject to the claims of their creditors. Additionally, since there is no right of survivorship between tenants in common, each party's interest will pass to their heirs or devisees as part of their estate upon their passing.

Joint Tenancy with Rights of Survivorship: Shared Ownership with Automatic Succession

Joint tenancy with rights of survivorship allows two or more natural persons to hold property together, with the property passing automatically to the surviving joint tenants upon the death of a joint tenant. Corporations, partnerships, trusts, and estates cannot be joint tenants. Each joint tenant holds an equal undivided interest in the property.

To establish a joint tenancy, the intent must be clearly specified, as it is otherwise assumed that the property is held as tenants in common. A joint tenant can transfer their interest without the consent of other joint tenants, but this action will sever the joint tenancy with the remaining joint tenants. Consequently, the holdover joint tenants will continue to hold the property jointly, while the new owner will become a tenant in common with the holdover joint tenants. Creditors of a joint tenant can typically satisfy their claims against that joint tenant's interest in the property.

Tenancy by the Entirety: Exclusive Ownership for Married Couples and Partnerships

Tenancy by the entirety is available exclusively to married couples, civil union partners, and reciprocal beneficiaries. Under this method, each person is considered the owner of the entire property while alive. This means that one party cannot unilaterally convey their interest without the consent of the other, requiring both parties to sign any conveyance documents.

Similar to joint tenancy, upon the death of one party, their interest automatically passes to the surviving party. Holding property as tenants by the entirety offers the benefit of individual creditor protection, as a person's individual creditors cannot use the property to satisfy individual debts. However, creditors of both parties may do so. It's worth noting that Hawaii law allows a couple's trusts to own property (as tenants in common) while retaining the creditor protection associated with tenancy by the entirety.

Conclusion:

Choosing the right method of property ownership in Hawaii is essential for the effective transfer, distribution, and control of your property in the future, especially for estate planning purposes. Gray Marino, a Realtor at Real Broker, LLC RS-86136, with expertise in handling these types of transactions, looks forward to helping you buy a piece of paradise in Hawaii. Contact Gray Marino at Gray@GrayMarino.com or call 808-745-7445 to learn more about the importance of selecting the appropriate ownership method for your property in Hawaii.

Categories

Recent Posts