Maui County condo median sales price sets all-time record at $908,000

Spiked by luxury sales, the median sales price for Maui County condominiums last month set a record high at close to $1 million, a new report said.

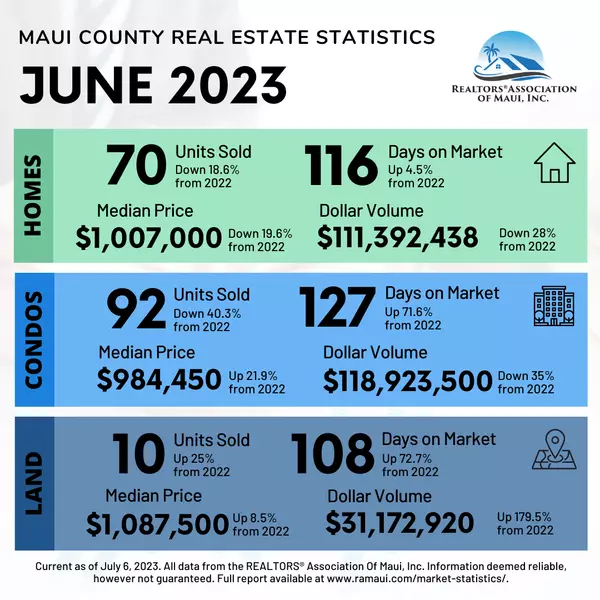

Maui County condo prices increased nearly 25% year over year to $908,000, according to a Realtors Association of Maui market activity report released this week. About a third of the condos that sold last month were in luxury areas with medians well over $1 million to $2 million.

Single-family homes, meanwhile, saw a median sales price of $1.07 million, which was again the highest in the state.

Kauaʻi’s median was $1.05 million, Oahu’s was $999,000, and Hawaiʻi island was $459,500, according to Locations Hawai’i. Median sales price is the point at which half of the sales sold for more and half sold for less, not accounting for seller concessions, in a given month.

While the median sales prices stayed high for Maui County, new listings, pending sales and overall sales continued to plummet. The decline in existing home sales has been recorded nationwide over the last 12 months as affordability constraints continue to limit homebuyer activity, national reports said.

Maui County single-family home sales dropped 50% year over year to 44 homes. Pending sales fell nearly 36% to 63 homes. And new listings fell 45% to 70 homes.

Days on the market until sale fell 12% to 102, and percent of list priced received stayed flat at about 97%.

Inventory increased year over year by nearly 22% — to 281 homes.

Condo prices in Maui County have remained in post-pandemic highs of the $800,000 range. The last median sales price record of $850,000 was set in November of last year. Prior to that, the high was $820,000 in April of 2022.

While prices are high, sales took a nosedive last month. Maui County condo sales fell nearly 60% to 66 units last month. Pending sales fell 55% to 82 and new listings fell 56% to 84.

While inventory rose about 36% to 225 units, the condos for sale are spending longer on the market. Days on the market until sale increased about 22% to 90 days.

When people are buying, they are slightly under the listing price. Percent of list price received dropped 2% from 100.4% to 98.4%.

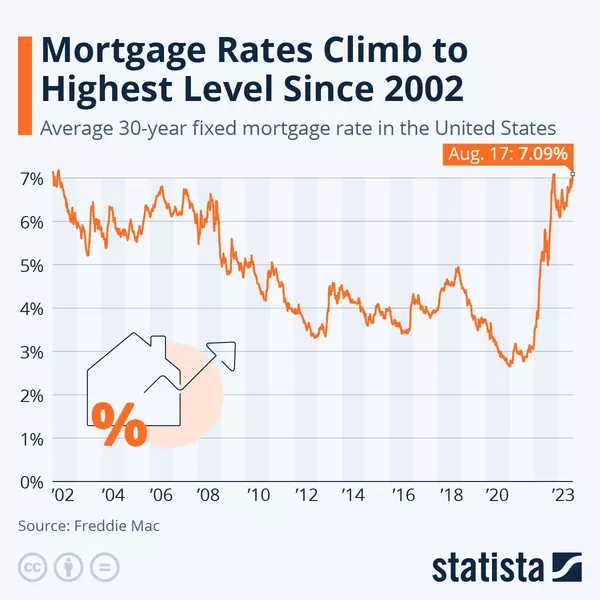

Neighbor Island buyers and sellers continued to find themselves in a stalemate last month, according to Coldwell Banker Island Properties. With mortgage interest rates forecasted to bounce between 6% to 7% in the foreseeable future, buyers and sellers were balancing housing affordability and the cost of switching properties.

“While many speculate as to the direction of the housing market, one thing remains for certain – a lack of properties for sale continues to keep median prices elevated even though there is less buyer competition, especially at entry-level prices,” Steve Baker, Coldwell Banker Island Properties principal broker, said in a news release.

For Maui County single-family homes, more than half the sales had median sales prices well more than $1 million. Median sales prices topped $3 million in Kā’anapali, Makawao/Olinda/Hāliʻimaile and Wailea/Mākena. The lowest median sales price was on Molokaʻi, $345,000 and on Lanaʻi, $757,000.

For condos, the median sales price topped $1 million and $2 million in Kā’anapali, Kapalua, Nāpili/Kahana/Honokōwai, Wailea/Mākena and Lāna’i. The lowest median sales prices were in Kahului, $275,000, and Wailuku, $400,000.

The National Association of Realtors said buyer demand is down from peak levels, and price growth has slowed even though prices are up from a year ago.

Sellers have been cutting prices and offering sales incentives in bids to draw buyers, the association said.

“The slight decline in mortgage rates earlier this year convinced some buyers to come off the sidelines, but with rates ticking up again in recent weeks, buyers are once again pulling back, causing sales activity to remain down heading into spring,” it added.

The Federal Reserve raised its benchmark interest rate in February by a quarter-percentage point to 4.50% to 4.75%, its eighth rate hike since March of last year, when the interest rate was nearly zero, according to the association. Mortgage interest rates have dipped slightly from their peak last fall, leading pending sales to increase 8.1% month-to-month as of last measure.

Categories

Recent Posts