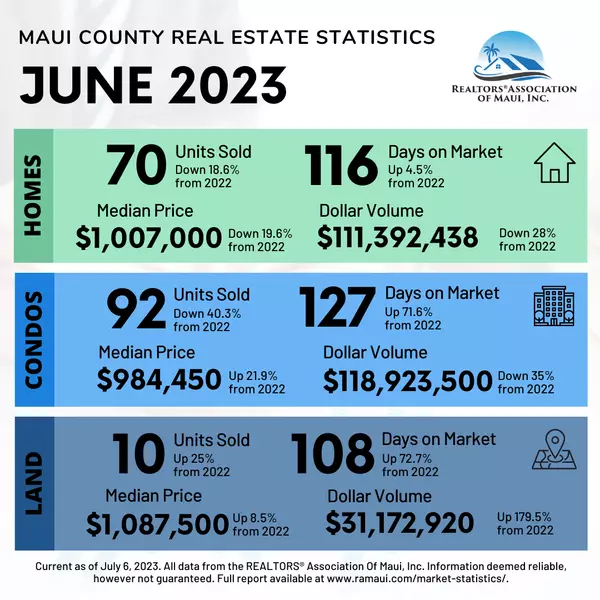

Finding the Perfect Real Estate Agent on Maui:

Choosing the Right Realtor on Maui Aloha! As a Real Estate Agent with extensive experience in the beautiful island of Maui, I know how crucial it is to find the perfect real estate agent to assist you with your property search. With breathtaking landscapes, world-class amenities, and a laid-back lif

Property Taxes by State: Discover the Lowest and Highest Tax Rates in the U.S. (Hint; Hawaii is the lowest)

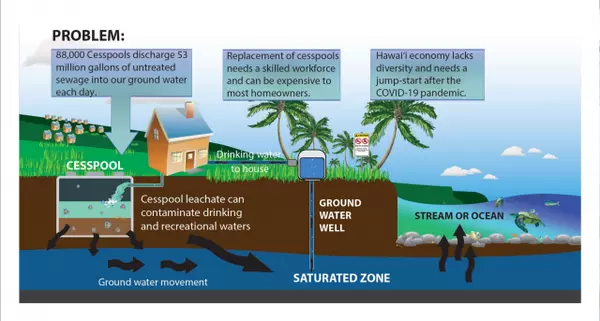

Property Taxes by State: Discover the Lowest and Highest Tax Rates in the U.S. (Hint Hawaii is the lowest) Property taxes can significantly impact your overall cost of homeownership, making it essential to understand the tax landscape before purchasing a home or investment property. In this blog p

Experience the Financial Advantage: Maui Property Taxes vs. Property Taxes in Other States

Maui Property Taxes vs. Property Taxes in Other States When considering a real estate investment, it's essential to understand the impact of property taxes on your overall financial success. Comparing property taxes between locations can help you make informed decisions and maximize your investment.

Categories

Recent Posts