Investing in vacation rentals on Maui!

As a real estate professional in Maui, Hawaii, I am often asked about the benefits of investing in vacation rentals on the island. Maui is a popular vacation destination, with millions of visitors each year, making it a great place to invest in vacation rental properties. Here are some things to con

What is Title Insurance? Do I need it on Maui?

As a real estate professional, I often get asked about title insurance and why it's necessary. Simply put, title insurance is a type of insurance that protects against any issues with the ownership of a property. When you buy a property, you're essentially buying the title to the property, which is

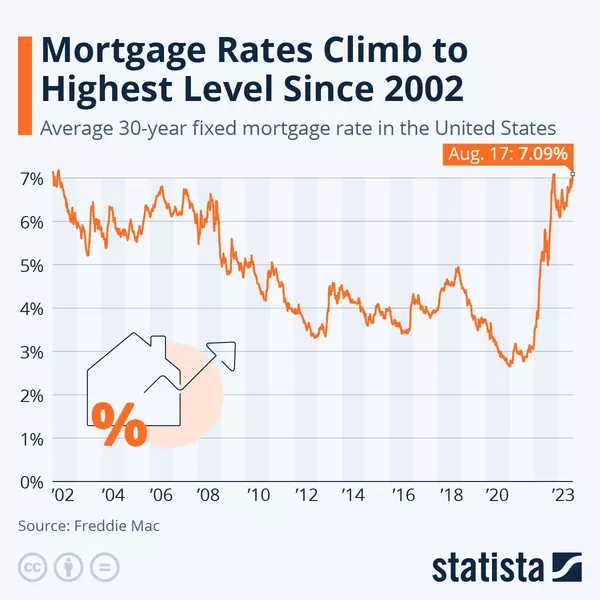

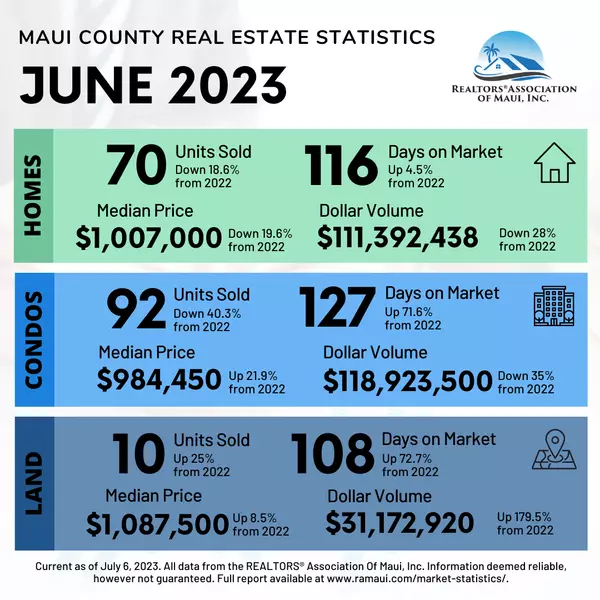

After pandemic buying frenzy, Maui home prices may ease — but not by much

A Kahului parcel with two homes is listed for sale Thursday at $995,000. PC: Kehaulani Cerizo Although Maui County’s real estate market is facing uncharted territory after the frenzied home buying of the pandemic, Realtors Association of Maui said signs point to slightly softer prices heading into t

Categories

Recent Posts