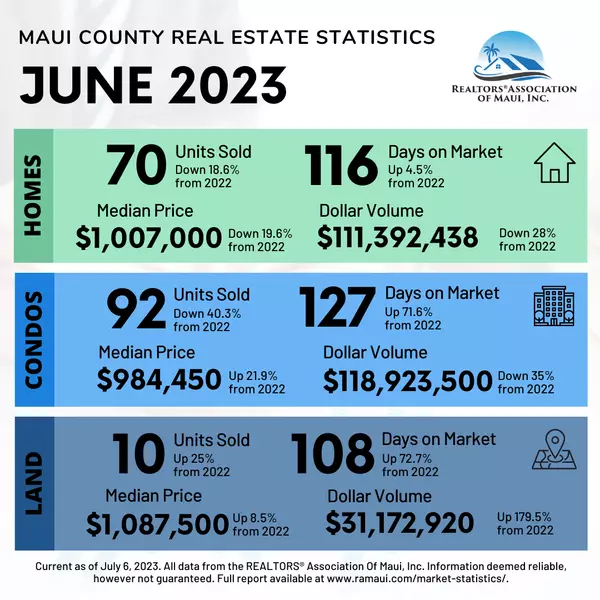

Maui County condo median sales price sets all-time record at $908,000

Harbor Lights condominiums are seen from Kahului Harbor. PC: Kehaulani Cerizo Spiked by luxury sales, the median sales price for Maui County condominiums last month set a record high at close to $1 million, a new report said. Maui County condo prices increased nearly 25% year over year to $908,000

After pandemic buying frenzy, Maui home prices may ease — but not by much

A Kahului parcel with two homes is listed for sale Thursday at $995,000. PC: Kehaulani Cerizo Although Maui County’s real estate market is facing uncharted territory after the frenzied home buying of the pandemic, Realtors Association of Maui said signs point to slightly softer prices heading into

Categories

Recent Posts